Doughnut

Our greatest challenge at present is dealing with the limits of the planet. The second greatest challenge is to provide for an acceptable standard of living for everyone. The third may be reducing differences in income and power. To a large extent these are economic questions. The order is important. For instance, what’s the point of achieving a higher standard of living when our planet is destroyed in the process? And it may be good to reduce differences in income and power but not if everyone ends up poorer.

New technologies can make these goals easier to attain. Information technology and the Internet made it possible for people everywhere around the globe to connect and to work together. This created jobs for millions of people in countries like India and China and it provided them with a better standard of living. Imagine nuclear fusion becoming available and energy becoming really cheap. That could halt climate change and make our lives easier. But we don’t know what kinds of technology there will be in the future.

The challenges we face are of an economic nature so a model of the economy can be helpful. Economics is about deciding for what we use the limited means we have and for whom. The distinction between economics and politics is not always clear because economic choices are often of a political nature. Even when you believe that everything should be left to markets then this is a political opinion.

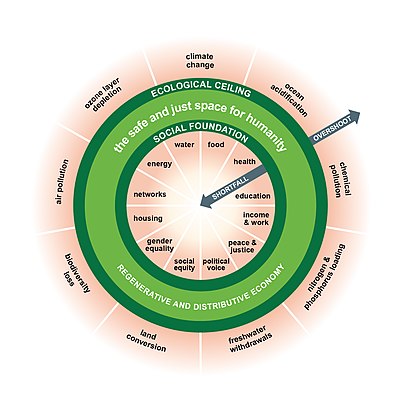

The economist Kate Raworth came up with the idea of doughnut economy. It can be used to assess the performance of an economy by the extent to which the needs of people are met without overshooting Earth’s limits.1 Assessing is not the real challenge here. Making it work is. Raworth did some suggestions but this model outlines a comprehensive global solution.

Much of economics is drawn from experience. Often from experience supposed economic laws were formulated. The supposed laws don’t always work so we need imagination too. Experience may be a good guide to predict human behaviour and it can help us to see how far we can make our imagination become reality.

We can’t continue to live like we do. New technologies alone will probably not save us. The changes we need most likely are a shock for most people, except the poorest. On the bright side there is the 20/80 rule. It states that if you set your priorities right, you can achieve 80% of what’s possible with 20% of the effort needed to achieve the 100%. So if we stop the 20% most resource consuming and polluting non-essential activities then we might achieve 80% of what we can possibly achieve. That may be enough so life may still be acceptable in the future.

This plan contains ideas that ignore political borders like combining environmentalism with supply-side economics. This is a comprehensive solution. People may take their pickings based on their political views but you can’t cherry pick and expect it to work. This plan doesn’t include specific proposals like building windmills nor does it dwell on sustainable development goals. It is an economic model only.

This model gives a general outline as to how to deal with the challenges using underlying economic mechanisms. Many issues have to be resolved along the way, for instance mitigating the consequences for those who suffer the most. In short the model is:

- The limits of our planet should dictate economics. That is just plain survival. Everything else should be of a secondary nature.

- Ending poverty should be the second goal in economic thinking. That is our moral obligation. All other goals come after that.

- People organise themselves in different ways. Organisational flexibility is the feature that made humans so successful as a species.

- Setting these limits will bring severe dislocations in the economy that have to be addressed in the short term as well in the longer term.

- Money is power. Ignoring money and the profit motive won’t produce acceptable outcomes. Still, it may be possible to reduce the power associated with money.

- The economy has a short-term bias. An important reason is interest. Negative interest rates can lengthen the time horizon of investment decisions.

- Capital represents wealth. Capital can help to make the economy sustainable and to end poverty. Destroying capital usually is not a wise course of action.

- It is probably easier to build the required capital via investment than via taxation as most people love to invest but hate to pay taxes.

- It may be better not to tax capital but to tax conspicuous consumption of the wealthy instead and to ban harmful activities if that is feasible.

Caring for our planet should be central in economic thinking. In traditional economics the consequences for the planet are delegated to a marginal role. The approach so far has been that products and services can have hidden costs like the usage of scarce resources and pollution. The proposed solution is that bureaucrats calculate these costs and tax harmful products to the point that their price reflects their true cost.

The government is supposed to use the proceeds from these taxes to repair the damage done, which often doesn’t happen. Still these taxes increase the price of harmful products so people can afford fewer of them. That may help but it is a proverbial drop-in-the-bucket. Economic growth is exponential so measures to reduce resource consumption or pollution are overtaken by the growth of production and consumption.

It is hard to calculate the true cost of products and services. Another problem is that green solutions use scarce resources too. To build a windmill energy is needed, which often comes from non-renewable resources like fossil fuels. Subsidising these solutions can be inefficient. A better way out may be setting hard limits on resource consumption and pollution. That could allocate resources more efficiently and set higher rewards on solutions that really contribute to a sustainable future.

Ending poverty is not always an explicitly stated goal of economics but economics is about making the best use of limited resources. Economic thinking can help to reduce poverty. Capitalism can create wealth efficiently but doesn’t distribute it equally. An important obstacle is interest rates being limited to the downside. Negative interest rates can help to reduce poverty but poor people are often poor for other reasons too, for instance a lack of opportunities or their own behaviour.

Human organisation

The political economy describes how humans organise themselves. Humans are social animals that can cooperate on a large scale in a flexible way. It made humans the dominant species on the planet. There are three major forms of human organisation:

- communities

- markets

- governments

Traditionally humans lived in communities and villages where people help each other. They contributed to their community and expected their community to care for them. Money hardly played a role and trade with the outside world was often barter. People were born into a community and it was difficult to leave. Communities are still important in modern societies but leaving is easier. Many communities are communities of choice that you can join and leave as you like. These are often based on shared interests, for instance a soccer club or a message board on the Internet.2

Markets can distribute goods and services efficiently. This is what is meant by the invisible hand. If people work in their own self-interest, this can benefit society because products and services are made according to the desires of individuals. The theory of supply and demand explains how that is achieved. This is done with the use of money in market transactions. In many instances markets fail to bring desirable outcomes. Markets are flexible but they do not think ahead so they do not take into account the limits of the planet.

Governments set the rules in societies and enforce them, often with the consent of the citizens. They provide public services that markets do not provide efficiently or in an acceptable manner. The organising agent is money too, in this case via taxes and government expenditures on public services. Governments can think ahead but they are less flexible. The limits of the planet aren’t flexible either so it may be a task for governments to enforce them.

Dealing with the consequences

The flexibility of the ways in which we humans organise ourselves allows us to set limits on a global scale and let governments, businesses and communities all over the world deal with them and reorganise themselves accordingly. These limits must be set from the top down like a dictate because the size of the planet can’t be changed. Being too flexible on this issue can be a greater mistake than not being flexible enough.

This requires a global authority. If adequate measures are taken, severe dislocations in the economy can be expected. For instance, if recreational air travel is to be ended, that will affect poor countries depending on tourism. The same is true for people working for businesses that use scarce resources produce non-essential goods and services. Millions of people will lose their jobs and their means of existence.

In the short run they have to be helped out with food and money. In the longer term people, communities, businesses and countries must adapt to the new reality. Multinational corporations may have to relocate jobs to areas that have little to offer to international markets. Ideally everyone has a useful role in society and feels secure but the economy requires a flexible labour market.

Money makes the world go round

Humans have social needs and varying motivations but most people are motivated by money, at least to some extent. Even when people are not motivated by money, those who are often determine what happens. That is because money represents power. Reforming the economy based on ideals and moral values will have little effect if money and financial markets are ignored. We need the goods and services money can buy.

People can be motivated by their jobs but most people work to make a living. Money plays an important role in this process. If you are not rewarded for doing your job well that can demoralise you, most notably if others receive the same reward for doing a poor job. A great experiment called the Soviet Union has proven that beyond reasonable doubt. Markets can help to eliminate businesses that are useless or inefficient.

Sadly the amount of money individuals acquire doesn’t always represent their merits for other people and society. The politically connected can enrich themselves at the expense of taxpayers. Business owners can exploit labourers and enrich themselves by moving jobs to low wage countries. And criminals can become very rich too.

Rich people can buy the respect and cooperation of others. They can make others do what they want them to do. This comes with social status. People like you when you are rich because they hope to benefit from your spending. Social status also comes from the products you can afford. Differences in power and social status can lead to social instability, most notably when many are poor and the rich didn’t deserve their wealth.

It is easier to finance a great endeavours like making the economy sustainable and ending poverty from investments than from taxation because nobody wants to pay taxes but everybody is happy to invest. People may work hard to build some capital for themselves through savings and investment but they won’t work so hard to pay taxes.

This was the secret of the success of the European empires that conquered the world. England, France, Spain and the Netherlands were much poorer and smaller than China, India or the Ottoman Empire, but they didn’t finance their conquests with taxation, but with investment capita. European conquerors took loans from banks and investors to buy ships, cannons, and to pay soldiers. Profits from the new trade routes and colonies enabled them to repay the loans and build trust so they could receive more credit next time.2

Reducing the power associated with money is possible. For instance, if there is a tax on currency, interest rates can go below zero, and owners of money can’t demand interest when there is a capital surplus and positive interest rates aren’t beneficial to the economy. Redistributing wealth via wealth taxes may reduce differences in wealth and power but it can also lead to capital destruction via higher interest rates.

Capitalists save and invest while ordinary people borrow and spend. Wealth taxes divert money from investment to consumption so interest rates may rise and the effect may be a reduction of capital rather than more tax income. And it is consumption that harms the planet. Wealth taxes can be useful but they aren’t part of the solution. It may be better to reduce the consumption of the wealthy instead as they often consume the most.

This would reduce the privileges attached to wealth as it reduces the options for the wealthy to use their riches. At the same time it allows capital to be allocated via markets so that efficiency considerations apply. Hence, more investment capital may become available and the excess may be transferred to governments, people and businesses via negative interest rates.

In other words, it may be smarter to ‘milk the capital of the rich’ by giving the rich fewer options to spend their wealth than to tax their wealth. In this way their capital may grow to the possible maximum and interest rates go lower to the benefit of everyone.

In the neo-liberal era government spending was constrained by interest payments. The public sector was neglected. The price paid was often poor health care, bad roads or an overstretched police force. Once interest rates are negative, we may enter an era of abundance, and interest payments may be added to government budgets. This is to be expected when resources are diverted away from the consumption of the rich.

I want it all, I want it all, I want it all, and I want it now.

– Queen, I want it all

Short-term bias

These words of Queen express the mindset behind an economic system that encourages people to buy as much stuff as possible. More is preferred to less and now is preferred to tomorrow. If we stop buying stuff, or even when we buy less, businesses go bankrupt, people become unemployed, debts can’t be repaid and money becomes worthless. And so there is a quest for economic growth that’s killing us.

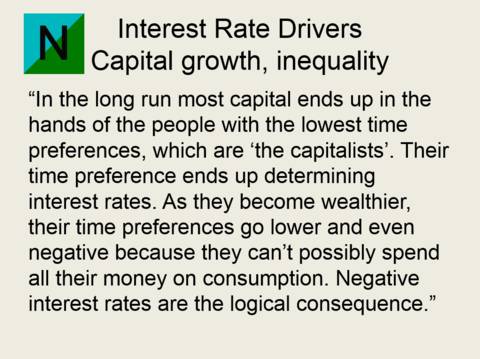

Economics teaches that our needs and wants exceed the available goods and services and that we always want more. This is called scarcity. Economics also teaches us that we want stuff sooner rather than later. This is called time preference. And so we must be encouraged to save for the investments needed to make more stuff by promising us more stuff in the future. And so there must be interest, economics teaches us.

To be fair, economics goes beyond this simple caricature, but the short-term bias caused by the belief in scarcity, time preference and positive interest rates, is still everywhere in economic thinking, and also in our thinking because we are influenced by economics. The existence of negative interest rates signals that the basic assumptions underlying economics may not be correct. People keep on saving without the promise of more stuff in the future. And that is a good sign.

Our way of living has to change in a fundamental way. We need to recycle more, buy second hand stuff and forego frivolous consumption. In the future employment may come from addressing needs in society. For instance, former salespeople may care for the elderly. There is an abundance of capital, and if those who have enough constrain their desires, even more capital can be available to meet the challenges humanity is facing.

To make that happen we need new ideas about wealth and poverty. It may be wiser to see wealth as the amount of time we can to sustain our current standard of living. For instance, someone who owns € 50,000 in assets and needs € 10,000 per year to live off may be wealthier than someone who owns € 100,000 and needs € 50,000 per year. This also applies to humanity. The resources of the planet can be considered as our assets. On the basis of this measure we are becoming poorer by the day.

Interest rates are important here. They affect the time horizon of investment decisions. That is because of discounting. When investment decisions are made, this usually comes down to discounting the future income stream from the investment against the interest rate. Higher interest rates promote shorter time-horizons. This can be illustrated with an example from the Strohalm Foundation:

Suppose that a cheap house will last 33 years and costs € 200,000 to build. The yearly cost of the house will be € 6,060 (€ 200,000 divided by 33). A more expensive house costs € 400,000 but will last a hundred years. It will cost only € 4,000 per year. For € 2,060 per year less, you can build a house that lasts three times as long.

After applying for a mortgage the calculation changes. If the interest rate is 10%, the expensive house will not only cost € 4,000 per year in write-offs, but during the first year there will be an additional interest charge of € 40,000 (10% of € 400,000).

The long-lasting house now costs € 44,000 in the first year. The cheaper house now appears less expensive again. There is a yearly write off of € 6,060 but during the first year there is only € 20,000 in interest charges. Total costs for the first year are only € 26,060. Interest charges make the less durable house cheaper.3

In reality things are not that simple. The building materials of the cheap house might be recycled to build a new house. And technology changes. If cars had been built to last 100 years, most old cars would still be around. This could be a problem as old cars are more polluting and use more fuel. Nevertheless, the example shows that long-term investments can be more attractive when interest rates are lower.

The interest rate is not the cause but the consequence of the time horizons of individual borrowers and lenders in financial markets, which are people, businesses and governments. The economy doesn’t magically become sustainable because interest rates are low. Interest rates are low for a reason. If we don’t buy things we don’t need, interest rates go down. The time horizon of the economy lengthens because our economic time horizon lengthens.

Capital and wealth

The painful reality of what our wealth really is has such dramatic consequences for the economy that it is hard to foresee what a future sustainable society might look like. But capital will still represent wealth in the future. The traditional definition of capital is buildings, machines, technology and knowledge to make the products and services we use. This definition ignores the planet and that is not helping us to survive.

Only if we think of the planet Earth as our main capital and believe that we have to keep that capital in tact and that we have to sustain ourselves from the interest of this capital then economics can help us to survive. We must reduce our consumption to the point that the planet can regenerate itself. A true capitalist doesn’t consumes his or her capital either. He or she lives of the interest and saves whatever he or she can for the future.

Traditional capital can help with that. For instance, internet and video conferencing allow us to meet other people without travel. If most traffic is to disappear that would greatly reduce resource consumption and pollution but that may only happen if travel is restricted. Knowledge to make artificial meat from plants can reduce the need for fertilisers and pesticides. If we don’t have to feed livestock any more, lower yields in agriculture are acceptable. This can help to make agriculture in harmony with nature.

We may need more traditional capital in order to sustain ourselves within the limits of the planet even though much of our existing capital may prove to be worthless. For instance, if research is done to make artificial meat taste better then people will find it easier to switch. In that case factory farms may become redundant. We may need massive investments in renewable energy and recycling as well as pollution reduction. If we set limits on our resource consumption and pollution then the capital that can make us live within these limits can be profitable.

As capital represents wealth, lower interest rates can increase wealth. That is because investments must at least generate returns equal to the interest rate. If returns are lower then it makes no sense to invest as it would be better to put the money in a bank account. Hence, with lower interest rates more investments are profitable and more capital can exist. It may explain why wealthy countries often have the lowest interest rates.

The requirement of making at least the interest rate in the market has enormous consequences. A corporation that makes a product people like can go bankrupt when potential customers don’t have enough money and the corporation can’t make enough profit. In other words, if an investment in this corporation yields less than the interest rate in the market, it must fail. That’s why corporations don’t make products for poor people. There is no profit in that. Some economists think this is healthy and natural.

In a similar vein a coal fired power plant that returns 6% is considered efficient and useful while a windmill that makes 2% is seen as inefficient and wasteful at an interest rate of 4%. This logic can be suicidal because of climate change. Something is terribly wrong with this. But if investments don’t make the interest rate in the market, no-one would make them voluntarily. Nowadays windmills and solar energy are profitable because the technology has improved and interest rates have fallen.

In a market economy capital exists for profit. Capital can exist for other motives too. A community can make an encyclopedia or a software product freely available on the Internet. A government can build a road or operate a library or a hospital. But history has demonstrated that people are motivated by money and profit and that a market economy is an effective way to build capital. In order to live within the limits of the planet and to end poverty, markets may need more guidance from governments.

With lower interest rates it may be possible to make investments in ending poverty and making societies sustainable profitable so that people will make these investments voluntarily. Perhaps it is better to make a distinction between what should be done, for instance making the economy sustainable and ending poverty, and what can be done, which depends amongst others, on the interest rate. At an interest rate of 0% the windmill could be profitable and fossil fuels can be phased out. That’s why lower interest rates can be beneficial.

Indeed, there are other measures for usefulness than profitability. Perhaps the requirement to make a specific interest rate may not seem particularly useful to humankind but it can help to allocate capital more efficiently. Hence, for the benefit of humankind capital markets must continue to exist and interest rates may need to be as low as possible to generate the investment capital needed for making the economy sustainable and ending poverty.

Governments should guide this process by defining what is legal and what is not. The investment options for capitalists depend on the products and services that are legal. As the number of options are reduced, for instance by banning resource consuming non-essential consumption, the remaining alternatives can become more attractive, most notably when the excess of investment capital drives interest rates lower so that sustainable production processes with low returns become feasible.

If there is a market

Banning harmful products can elicit black markets, most notably when these products are addictive or save you from a lot of trouble or hard work and if you can use them without being noticed. It would be hard to stop the use of alcohol and drugs because people will use these products anyway. It may be easier to limit air travel as it will be difficult to fly a plane without being noticed.

Black markets and fraud are likely to arise if limits are set on the extraction of resources like fossil fuels and basic materials. The price of these resources could rise and it could be lucrative to extract more than is allowed. It might a good idea to look for places where effective control can be established. That may be on the demand side by banning or limiting certain activities or on the supply side by monitoring production.

Distortions in the markets for resources can produce losses or profits. Governments may need to take ownership of resources and compensate the owners. A government can then contract a miner to mine resources based on quota under specific regulations, and the miners can then be paid for extracting the resources. If markets become distorted by forward-looking planning then governments must intervene.

Perhaps different arrangements are possible. When interest rates are negative then future income discounted against the interest rate will have a higher net present value so it can make economic sense to keep resources in the ground.

Global competition drives down prices and it allows developing nations to build their economies too. Free trade can benefit humankind because it allows people and countries to specialise in what they do best so more and better products can be made at lower prices. Regulations aim to increase the quality of products by setting minimum standards. Regulations can favour large scale operations if they require large investments.

If the economy is to become sustainable the energy cost of producing items as well as the cost of transport may change and affect the scale of production. Regulations can stand in the way of scaling down and localising production but in many cases regulations, for instance regulations about food safety, exist for good reason. Investments to make production processes sustainable may be costly and may also favour economies of scale.

Confidence in money and trust in the financial system

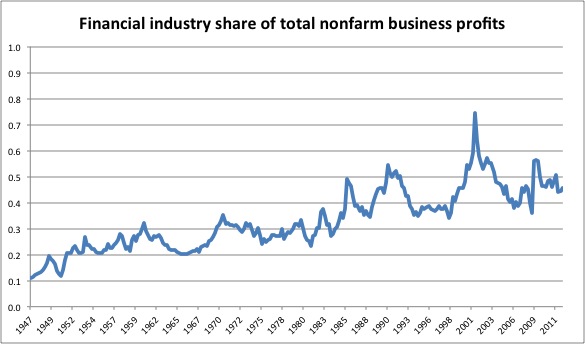

Confidence is key in the capitalist economy because credit is based on confidence. The availability of investment capital comes from confidence in financial system and the economy. Actions that erode trust affect the available credit. Bank failures shatter confidence and stop the circulation of money. The Great Depression really took off after banks went bankrupt. The financial crisis of 2008 escalated once Lehman Brothers was allowed to go bankrupt.

To ensure that businesses can prosper credit must be available. A lack of trust in financial markets results in a destruction of capital. It is not a coincidence that economic crises are often preceded by a financial crisis. That’s why governments and central banks stand behind the financial system and support it at all cost. That’s why we seem to be hostage of the financial system. It doesn’t have to be that way.

Interest on money and debts makes the financial system unstable and prone to crisis because incomes fluctuate while interest payments are fixed. And because there is currency at an interest rate of zero, investors can flee to the safety of currency at no cost whenever there is some trouble. But interest rates are poised to go negative. This may be the opportunity to make the financial system more robust by charging a holding fee on currency and banning positive interest rates on money and debts.

Trust in the financial system and debts is reflected in the interest rate. If the interest rate is negative then investors prefer a certain loss to other investment alternatives. That might happen because of confidence in the currency as a store of value, for instance when inflation is non-existent. It is imperative that governments promote confidence in their currencies by limiting their primary deficits to the point that they are paid from the interest received on their debts.

Interest is the price paid for distrust so governments must be reliable and transparent to inspire confidence in financial markets. If a government is not honest to its creditors then the interest paid on its debts can rise. People like entitlements and do not like taxes so citizens may elect politicians who promise more entitlements or lower taxes. The interest rate on government debt can therefore also reflect the confidence of creditors in the citizens of a country.

A robust financial system that inspires confidence can meet the challenges that lie ahead as they will on the one hand require an unprecedented amount of capital in form of knowledge, new products and new ways of producing and distributing them, while on the other hand there will be severe shock and dislocations in the economy that only a robust financial system can withstand.

A holding fee on currency can ensure liquidity in financial markets so that the economy will not fall apart in times of economic stress. The situation in Wörgl demonstrated that even a deep depression can soon end with negative interest rates. The transformation to a sustainable economy requires an unprecedented amount of low yielding capital that may only be made profitable when interest rates are negative.

Investment guidance policies

For markets to do their job properly, capitalists should deploy their capital in the way they see fit within the options that are available. Additional measures may be needed to guide investments into desired directions like developing countries, recycling, and affordable housing. Wealthy individuals should realise they have a moral duty to make their capital contribute positively to society and the well-being of others. And even if the wealthy do not live up to their moral obligations, the laws and the financial system must channel their efforts in the right direction.

Financing the challenges of the future by investors may work better than financing them from taxes. Investors tend to chose the options that generate the most profits. In doing so they may be able to realise these goals more efficiently and generate more investment capital for the purpose. Favouring desired investments, for instance by excluding them from a wealth tax, can be a way to make them more attractive.

Products should cause as little harm as possible to the planet. Nature should be able to regenerate itself and undo the harm done. To make that possible, corporations should be responsible for the lifecycle of their products. Even when they work with contractors, the responsibility should remain with the corporation that markets a product.

During the neoliberal area businesses were often allowed to regulate themselves. This is didn’t work out well as businesses can gain an advantage from evading responsibilities in the form of reduced costs and higher profits. Governments have a responsibility to make and enforce the law. That may not be enough so journalists and activists have a duty to press businesses into sticking to the rules and governments into enforcing them.

Summary

This is an economic model meant to identify the economics to make the economy sustainable and to end poverty. There will probably be consequences that aren’t fair and they should be addressed where possible. Capital represents wealth. To make the economy sustainable we need a different view on wealth as it not being the amount of assets you currently have but the time your assets can support your lifestyle.

The planet should be seen as our main capital, not the buildings, machines, technology and knowledge to make the products and services we use. If we use more than nature can replenish, we use more than the interest of our main capital, and we become poorer as a consequence, even when the interest rate on traditional capital is positive.

To make the economy sustainable and to end poverty while maintaining an acceptable standard of living requires an unprecedented amount of traditional capital. The effort can better be financed from investments than taxes. Lower interest rates can make investments in making the economy sustainable and ending poverty more attractive.

Limiting our production and consumption will depress interest rates. Low interest rates require trust in the financial system and currencies. The financial system is based on debt, hence the integrity of debtors. A maximum interest rate of zero can improve the quality of debts. A holding fee on currency can ensure liquidity in financial markets.

Instead of spending on frivolous consumption everyone who can afford it should become a capitalist and invest in his or her own future. That can help to make the economy sustainable and to end poverty. Governments can support this process by legislation that bans harmful products and supports investments in areas that are beneficial.

Featured image: Doughnut economic model. Kate Raworth (2017). . CC-SA 4.0. Wikimedia Commons.

1. Doughnut economics: seven ways to think like a 21st century economist. Kate Raworth (2017). Vermont: White River Junction.

2. Political economy. Wikipedia. [link]

3. Sapiens: A Brief History Of Humankind. Yuval Noah Harari (2014). Harvil Secker.