Trade and finance

In the past, ordinary people regarded merchants and bankers with suspicion. In popular culture, trade and banking were the domains of people of questionable ethics. Merchants are as slippery as eels, so it is hard to pin down the issue, but everywhere you see the death and destruction they cause. Hermes, the Greek god of trade, was also the god of thieves. Jesus Christ chased the money changers from the Jewish temple. In The Parable of the Talents, however, Jesus said that you must put your qualities to work. Talents were money, so it could mean putting your money to work. And Jesus said that it is easier for a camel to go through the eye of a needle than for a rich man to enter the kingdom of God.

Jesus lived 2,000 years ago. Economics as we know it now didn’t exist, so we can’t blame him for lacking a consistent view on economics. Someone claiming to be Paul added that the love of money is the root of all sorts of evil. The Jewish sage Jesus Sirach noted, ‘A merchant can hardly avoid doing wrong. Every salesman is guilty of sin.’ The Jews and Protestants excluded him from their canons, but his musings are in the Catholic Bible. Greed, or the pursuit of profit, drives trade. Traditional moral systems considered it wrong. We have gone a long way since then. Today, we hold a different view and see trade as mutually beneficial, so those who engage in trade do so voluntarily because they all benefit. Eels are very slippery indeed. And so are merchants.

Today, trade and finance are at the core of our economic and moral system. And so, Friedrich Hayek could write, ‘The disdain for profit is due to ignorance and to an attitude that we may, if we wish, admire in the ascetic who has chosen to be content with a small share of the riches of this world, but which, when actualised in the form of restrictions on others, is selfish to the extent that it imposes asceticism, and indeed deprivations of all sorts, on others.’ Our ethic is that we can do as we please, as if consequences don’t exist. And the ascetic is selfish when he says everyone should live like him. It is moral depravity at its finest. And so, what was good has become evil, and what was evil has become good.

The problem is not self-interest as such, but greed or the ethic of the merchant, and that the difference isn’t clear. Many merchants are people like you and me without evil intent. Shop owners make a living like everyone else and provide their customers with a service. They are often people who care, not the greedy, evil kind that run Wall Street or sell weapons to warring factions in Africa. But something is profoundly wrong with trade. Even a shop owner doesn’t produce something. They provide a service by trading in markets. And individual merchants may have ethical values, but markets never have them. Everything is for sale. Suppressing trade promotes illicit markets and crime. And so, we accept the drawbacks, thinking the alternatives are worse. That is a fatal mistake.

A pragmatic approach says that outcomes matter more than intent, so if the result of nefarious intent, like greed, is good, it is good. And if the outcome of good intent is terrible, it is wrong or perhaps even evil. If factory owners destroy artisans’ businesses and pay their employees low wages, but overall opulence increases as cloth becomes cheaper, then it is good. Likewise, if a country switches to socialism out of good intentions, but the population starves, it is evil. Before the Industrial Revolution, nearly everyone was as miserable as today’s poorest. Capitalism has lifted billions out of poverty. So why bother?

Trade and finance became the engine of growth, bringing industrialisation, modernisation, colonisation, the slave trade, mass migration, the loss of livelihoods for craftspeople, and the depopulation of the countryside. Various movements, such as socialists, anti-globalists, religious groups, small-is-beautiful, and environmentalists, attempted to provide alternatives to the current order with their visions of Paradise, but they all failed. The system is amoral, a brute force driven by our sentiments and urges. As consumers, we crave the best service at the lowest price, and as investors, we desire corporations to increase their profits. And we don’t think about the consequences.

Usury: the destroyer of civilisations

Money is to the economy what blood is to the body. It must flow. Otherwise, the economy will die. If we stop buying stuff, businesses go bankrupt, we become unemployed, the government receives no taxes, and everything comes to a standstill. That never happens because we spend money on necessities like fast food, smartphones, and sneakers. When we buy less, the economy slows, and we enter a recession, or if it gets worse, a depression. Businesses disappear, and people become unemployed and depressed. Usually, the economy recovers, but it may take time, sometimes decades. It is why we must keep buying stuff, and even more, to make the economy grow.

In the past, when borrowers couldn’t repay their debts, they became the moneylenders’ serfs. It is why several ancient civilisations had regular debt cancellations and why religions like Christianity and Islam forbade interest on money or debts. Usury is paying for the use of money, which is a profoundly evil practice. The evil of it lies in the money flows. We all need a medium of exchange. A simple explanation helps to clarify the issue. Imagine the Duckburg economy running on 100 gold coins. With these 100 gold coins, everyone has enough money, and the Duckburg economy operates smoothly. Scrooge McDuck owns ten, but he is a miser and doesn’t use them to buy items from others.

The economic flows of Duckburg now suffer a 10-coin shortfall. Products then remain unsold, and several ducks lose their jobs. To prevent that, Scrooge McDuck can lend these coins for one year at 10% interest to ducks who come short, so the money keeps flowing. At the end of the year, the economy is 11 short. Scrooge McDuck then lends 11 coins at 10%. In this way, he will own all the coins after 25 years. Scrooge McDuck can implode the Duckburg economy by keeping the money in his vault. When the citizens of Duckburg become desperate, Scrooge McDuck can buy their homes, let them pay rent, and become even richer. If you think that is smart, you have the ethics of a merchant. It demonstrates why, in traditional popular culture, merchants and bankers were evil.

Two things have changed since then. Starting with the Industrial Revolution, economic growth picked up, which helped to pay for the interest charges. The nature of money has also changed. It isn’t gold anymore. Nowadays, banks create money from thin air, so the nature of usury has also changed. When you go to a bank and take out a loan, such as a car loan, you get a deposit and a debt that the bank creates on the spot by creating two bookkeeping entries. The deposit becomes someone else’s money once you purchase the car. When you repay the loan, that bank deposit and the debt disappear. You must repay the loan with interest. If the interest rate is 5% and you have borrowed € 100 for a year, you must return € 105.

Nearly all the money we use is deposits created from loans that borrowers must return with interest. Banks might pay interest on deposits. The depositors of a bank act like Scrooge McDuck. They have more money than they need and keep it in the account at interest. If they have borrowed € 1,000,000 at 5% interest, they must return € 1,050,000 after a year. Where does the extra € 50,000 come from? Here are the options:

- borrowers borrow more;

- depositors spend some of their balance;

- borrowers don’t pay back their loans;

- the government borrows more or

- the central bank prints the money.

Problems arise when borrowers don’t borrow and depositors don’t spend their money. In that case, borrowers are € 50,000 short, and some can’t repay their loans. If many borrowers can’t, you have a financial crisis. Borrowers can reduce their spending to pay off their debts, leading to a slowdown of the economy. The economy is also unstable due to investor expectations. They expect more in the future. If debts remain unpaid or people stop spending, they incur losses and may lose trust and stop investing.

If they lose trust, they stop investing, less money flows into the economy, businesses go bankrupt, people become unemployed, and more borrowers get into trouble. As a result, even less money flows, causing banks to go bankrupt. Economists call it deflationary collapse. That happened in the 1930s, causing the severest economic depression in modern history. There was no money in the economy because lenders feared losing it. To prevent that from happening, governments run deficits and central banks print currency whenever there are shortages in the money flows. With interest on debts, these things are hard to avoid. But if the system never collapses, debts and interest payments only grow.

The 2008 financial crisis could have been much worse than the 1930s, potentially leading to the collapse of civilisation as we know it. That was due not only to the accumulation of far more debts but also because most people now live in cities, where they have become dependent on markets and governments. In the 1930s, most people still lived in the countryside. Central banks prevented a collapse by printing trillions of US dollars, euros, and other currencies. The shortfall was that enormous. We now buy our necessities in shops and rely on the government to keep the system running. We have not only become the usurers’ hostages, but also the hostages of markets and governments.

Barataria: an economic fairy tale

Money equals power, and the lure of riches corrupts us, so the alternatives to the system of trade and usury have failed. They can’t compete. A few people step out, but it is like a rehab from a consumption addiction. It is a sober life while everyone around you keeps on living the good life. After us, the deluge is the prevailing mood. The deluge is already taking off. Storms feed on the warming sea water and leave their burden on our shores. But what are our options anyway? In the early 1990s, the Strohalm Foundation published The Miracle Island Barataria, an economic parable by the Argentinian-German economist Silvio Gesell.1 I rewrote the narrative somewhat to better highlight its message. Gesell explores three options: (1) communism or socialism, (2) a market economy without traders and bankers, and (3) a fully capitalist economy.

In 1612, a few hundred Spanish families landed on Barataria, an island in the Atlantic, after their ships had sunk. The Spanish government believed they had drowned, so no one searched for them, and they became an isolated community. They worked together to build houses, shared their harvests, and had meetings in which they decided about the affairs that concerned everyone. It was democracy and communism. After ten years, the teacher, Diego Martinez, called everyone into a meeting. He noted that working together and sharing had helped them build their community, but the islanders had become lazy. They came late to work, took long breaks, and left early. They spent their time at meetings discussing what to do, but much work remained undone.

‘If someone has a good idea, he must propose it in a meeting to people who don’t understand it. We discuss it but usually we don’t agree or we don’t do what we agree upon. And so, nothing gets done and we remain poor. We could do better if we have the right to the fruits of our labour and take responsibility for our actions,’ Martinez said, ‘The strawberry beds suffered damage because no one had covered them against night frost.’ He mentioned several other examples. Martinez said, ‘If the strawberries are yours, you protect them. And if you have a promising plan you think is worthwhile and you can keep the earnings, you do it yourself and hire people to help you.’

He proposed splitting the land into parcels and renting them to the highest bidder to finance public expenses. Fertile lands would fetch a higher price than barren ones, giving everyone an equal opportunity to make a living. He also proposed introducing ownership so the islanders would feel responsible for their property. But with property, you need a medium of exchange or money. The islanders decided to use potatoes as money. Everyone needed potatoes. They had value, so they were good money.

Potatoes are bulky, thus difficult to carry, and they also rot. At the next meeting, Santiago Barabino proposed setting up a storehouse for potatoes and issuing paper money, which could be exchanged for potatoes when needed. So, you had banknotes of 1, 2, 5 and 10 pounds of potatoes. The Baratarians agreed. The notes had a date of issue and gradually lost their value to cover the storage cost and rot. If you returned the banknote to the potato storage after a year, you received 10% less. And because the issue date was on the banknote, buyers and sellers knew its value.

For several years, Barataria had banknotes representing stored potatoes. Their value declined over time to pay for the storage and the rot. Borrowers didn’t pay interest. If you had savings, you would lend them to trustworthy villagers if they agreed to return notes representing the same weight. The notes lost value, making everyone spend their money quickly and store items and food in their storehouses. The general level of opulence rose, but there were no poor or rich people. There were no merchants buying things at a low price to sell them at a high price. Businesses didn’t pay interest, and there were no merchants, so things were cheap in Barataria. The chronicle notes that the islanders acted as good Christians and helped each other.

Then Carlos Marquez had a new idea. He addressed Baratarians, ‘How many losses do housewives suffer from keeping food in their storehouses? We shouldn’t put our savings in perishable products, but money with stable value. We can back our money with something we don’t need and doesn’t deteriorate. The Pinus Moneta is a nut we can’t eat, and doesn’t rot,’ he said, ‘We don’t have to back money with a commodity of value like potatoes. The things we buy and sell give the money its value. If we do that, we can buy things when we need them and don’t have to store them ourselves.’

What a great convenience that would be. It seemed too good to be true. Diego Martinez argued against the proposal. He told his fellow islanders that a medium of exchange passes hands. It remains in circulation. But savings stay where they are unless those who are short of money borrow them and pay interest. You end up paying interest to use the currency you need to buy the things you need. His argument was to no avail. And that is the price of democracy. People often decide about questions they don’t understand.

Most islanders preferred to spend their time getting drunk in the pub instead of studying the issues of government. And if you are doing well, you can’t imagine that seemingly insignificant errors can ruin you. Marquez spoke passionately, while Martinez warned cautiously, saying things were fine as they were and he couldn’t foresee the consequences. That swayed opinions. The islanders switched to money backed by the Pinus Moneta. This money didn’t lose its value. That made it attractive to save money.

Suddenly, everyone tried to exchange their supplies for the Pinus Moneta, causing mayhem in the marketplace. Everyone brought everything they had to the market. But no one could sell their goods because everyone wanted money. That was until the company Barabino & Co came up with a plan. Barabino & Co. set up a bank with accounts that Baratarians could use for saving and making payments. Everyone could bring their money to the bank and receive an extra 10% after a year. The naive Baratarians agreed. They could have known there weren’t enough nuts of the Pinus Moneta to pay the interest. And they didn’t ask themselves how Barabino & Co. would generate the profits to pay that interest. With this borrowed money, Barabino & Co. bought goods from the islanders and deposited money into their accounts, but Barabino & Co. only purchased food and seeds.

The following spring, Barabino & Co. hiked food and seed prices. Most islanders paid more for food and seeds than they received in interest. They went into debt with Barabino & Co. With the profit, Barabino & Co. bought the next harvest and cranked up food prices even further. Soon, Barabino & Co. owned everything. Most were in debt and worked hard, but a few wealthy people lived off interest income. They didn’t work and lived a life of luxury on the interest on their accounts. The Baratarians needed money to pay for the items they bought from Barabino & Co. They had to borrow this money from Barabino & Co. and pay interest to use it. There weren’t enough nuts to pay back all loans with interest, so the islanders went further into debt year after year. They paid interest on money the bank created out of thin air, giving it to the wealthy. That is usury.

The Baratarians worked harder and grew more creative in earning money. The islanders invented, produced and sold more products, most notably wooden items made from the trees on the island. Not everyone could keep up, and more people lived in the fields. At least, the economy grew, and the Baratarians grew accustomed to luxuries they hadn’t had before. They had wooden chairs, boxes, ornaments, toys, outhouses, carts and tables. The islanders had managed without these items before, but now, they believed they needed them.

The change came with other unfavourable consequences. The Baratarians became agitated, deceitful, and immoral. Crime rose as everyone desired the luxuries that the rich enjoyed, and for which they didn’t have to work. Of their Christian faith, not much remained except an empty shell. They were busy making money. Then came the day the Baratarians had cut down all the trees on the island. They suddenly lacked the wood needed to make the tools for harvesting their crops, and they starved. That was the day the Pinus Moneta lost its value. After all, you can’t eat money.

Adam Smith and the Wealth of Nations

The tale tells how devious acts contributed to an outcome most of us now deem desirable. By selling our souls to the money god, most of us have a better life than people in the Middle Ages. That improvement came with wars, colonialism, the slave trade, pollution, and miserable working conditions, and ultimately, it could bring the end of human civilisation. With the help of saving and investing, capitalists build their capital. Capitalism is about making sacrifices in the present by saving to have a better future via investing. It also led to a mindless process called competition via innovation and economies of scale. Economists call it creative destruction.

In the original tale, the wood didn’t run out, but the British rediscovered the island to find a class society much like theirs. The story tells how devious acts contributed to an outcome most of us now deem desirable. By subjecting ourselves to this system of trade and usury, most of us live a more agreeable life than people in the Middle Ages. It came with wars, colonialism, the slave trade, pollution, miserable working conditions, the destruction of communities and societies, and, eventually, the end of human civilisation. With the help of saving and investing, capitalists build their capital. Capitalism involves making sacrifices in the present by saving to have more in the future via investing. You can always do better. It promoted competition via innovation and economies of scale. But there is no ultimate goal, a vision of Paradise, only creative destruction without end.

The Baratarians were in debt, worked hard and were creative. Those who couldn’t keep up became homeless. As there was never enough money to pay back the principal with interest, the Baratarians went deeper into debt, worked even harder and became more creative by inventing and selling new products, producing an economic boom that ended in starvation once the trees were gone. It looks like the problem we face. The Earth’s resources are finite, and interest accumulates to infinity. Our money becomes worthless once there is nothing left to buy or sell.

Adam Smith, the founder of modern capitalist thought, claimed that pursuing our private interests promotes the public good. A baker doesn’t bake bread to serve the community but to make a living. It is why we have something to eat. The baker doesn’t want to lose customers, so he bakes what they desire. Otherwise, they go to his competitor. Smith believed it would work out well as humans are moral creatures. We temper our behaviour as it affects others. Therefore, moral relativists could argue that we don’t need public interest. The private interest will do just fine. But it is not how markets operate. We may have ethical values, but markets never have them. The least scrupulous usually wins the competition, so the greater evil usually wins in the markets. We have found that out and now want governments to oversee the markets.

Factory owners didn’t consider the plight of the artisans they put out of business or the miserable working conditions of their workers. They would have gone out of business if they had done so. Moral considerations don’t drive business decisions, so psychopaths end up in high places in corporate management.2 These psychopaths in business provide us with harmful products like cigarettes, prostitution, gambling casinos, and semi-automatic rifles. They expand their market by advertising their wares. A merchant will say, ‘If I don’t supply the market, someone else will, so why not profit from death and destruction myself?’ The merchant then claims liberty is the highest value, and restricting markets equals oppression, thus the ultimate evil. Why not let everyone buy cocaine and semi-automatic rifles? It increases GDP. These are the morals of the merchant we now live by.

Without self-interest and trade, we would be poorer, and poverty was Smith’s primary concern. Increasing production was the way out. Self-interest and trade were the tools to achieve that. It succeeded marvellously. Since the Industrial Revolution, production increases have lifted billions of people out of poverty. Adam Smith argued:

- The division of labour drives production increases. If you specialise in a trade, you can do a better job or produce more at a lower cost.

- A market’s size limits the division of labour. Transport costs limit market sizes. Energy cost drives the volume and distance of trade.

- Merchants preferred precious metals as money. It enabled them to store their gains, allowing them to wait for opportunities to make financial profits.

Producers produce items at different times, in different locations, and in different quantities than consumers need. That is why we trade. Traders bridge those gaps by storing, transporting, and dividing goods. Trade promotes large-scale production and labour efficiency, so fewer people provide for our necessities. That allows for more fanciful products and services and industries, thus a higher standard of living.

The evil empire of trade and usury

Economic and financial power translates into military power. The Europeans didn’t finance their conquests with taxes but with the profits from their colonial enterprises. No one likes to pay taxes, but everyone loves a profit. The scheme thus became an unprecedented success. Venture capitalists paid for the first ships, hoping to find new trade routes and riches. And they found them. The Europeans reinvested their profits, so their capital grew, and their financial and military strength increased.

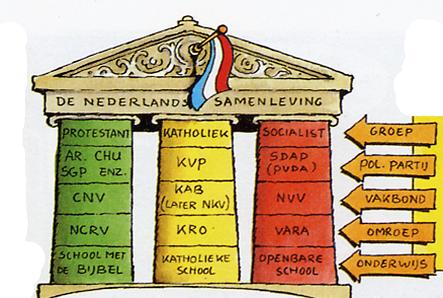

After the bourgeoisie had taken control of the British government during the Glorious Revolution, the British state became a venture of the propertied class, like the Dutch Republic already was. The Dutch Republic, run by merchants, was the most successful and wealthiest nation at the time. The British imported knowledge of Dutch governance by appointing a Dutch governor as their king. In the following centuries, Great Britain became the world’s largest empire.

The British bourgeoisie benefited from a functioning state and was willing to pay for it. The storyline is that taxation became legitimate as it had the consent of the taxed. The British bourgeoisie didn’t like to pay for corruption or ineptitude, so the state’s performance improved.3 With its secured and enlarged tax base, the clamp down on corruption and ineptitude, the invention of modern banking, including a central bank, trust in British financial markets improved, and Great Britain could borrow more at lower interest rates.

It helped Great Britain to defeat France, a country with twice as much wealth and twice as large a population. In France, the wealthy didn’t pay taxes, and the government was always short of funding. France defaulted on its debts several times. The French government was inept and corrupt, which made lenders unwilling to lend to it. The British economic successes, thus having a large market, low interest rates, and high wages, helped to ignite the Industrial Revolution.

During the Napoleonic age, several European countries modernised their governments into modern bureaucracies, with career paths based on qualifications and merit. The British later also modernised their administration, aligning it more with the rational principles of government that other European countries had adopted after the French Revolution.4 The benefits of the division of labour imply it is better to let bureaucrats run bureaucracies and businesspeople run businesses. You don’t let government bureaucrats run a business, nor do you allow your businesspeople to run the government.

The United States followed a different path. When the Founding Fathers set up their new state based on the modern principles of their time, they were ahead of Europe. They introduced regular elections for the president and parliament and a separation of powers between the administration, parliament and the judiciary, thus creating checks and balances to prevent dictatorship or mob rule. The US also became the first democracy. All free men had received the right to vote by 1820.4 Several European countries later followed suit.

The US administration, however, didn’t become a modern professional bureaucracy at first, and the US government remained plagued by corruption, cronyism, and the presence of unqualified individuals. Politicians gave their supporters government offices when they won the election.4 In 1881, a disgruntled man who had campaigned for US President Garfield and sought a diplomatic job as compensation shot the president. Appointing people for political reasons had become unthinkable in most of Western Europe. Modernisation efforts in the US began in the 1880s, took decades, and never fully succeeded. Political appointments are now making a comeback.

The founding fathers had set up the United States as an oligarchic republic run by the propertied classes, similar to Great Britain and the Dutch Republic. Rather than leaning on a clean government like the British elites, the American elites learned to employ corruption, for instance, via campaign financing, bribing judges, and funding think tanks that advise the US government. After World War II, the United States emerged as a superpower, and the gold-backed US dollar became the currency used in international trade. To finance its military, the US began to run deficits in the 1960s and ended the exchangeability of the US dollar for gold in 1971. The US dollar then became the de facto reserve currency, most notably because oil-exporting countries continued to accept the US dollar.

The US dollar’s reserve status allowed the US elites to employ the productive capacity of the rest of the world for their empire. Foreign countries delivered goods and labour in exchange for US dollars, which the United States printed out of thin air. The US financial elites in institutions like the World Bank and the IMF pushed developing countries into US dollar debts, which made them depend on exports to serve the US empire. As a result, the domestic economy of the United States began to suffer from the Dutch disease. The Dutch natural gas exports created a demand for the guilder, which drove up the Dutch currency and made Dutch industries uncompetitive in the 1970s.

The Dutch remedied the issue in the 1980s by making a collective national agreement between the government, employers, and unions to keep wage increases below those of its competitors for several years. Demand for the US dollar, however, increased, not because of exports, but because of foreign nations being dependent on it, pushing up its value and eroding the competitiveness of American manufacturing. And the US didn’t need to correct that issue, because of the US dollar’s reserve status.

The US dollar has become an international store of value, and so has US government debt. There was even pressure to go into debt, to satisfy the global demand for US dollars. As a result, deficits have escalated further, and the American economy depends on controlling the world’s financial markets. The American empire is now the Evil Empire of Trade and Usury, the Babylon of our time. However, the end of an empire doesn’t always turn things for the better.

Latest revision: 7 August 2025

Featured image: cover of The Miracle Island Barataria

1. Het wondereiland Barataria. Silvio Gesell (1922).

2. 1 in 5 business leaders may have psychopathic tendencies—here’s why, according to a psychology professor. Tomas Chamorro-Premuzic (2019). CNBC.

3. The Origins of Political Order: From Prehuman Times to the French Revolution. Francis Fukuyama (2011).

4. Political Order And Political Decay. Francis Fukuyama (2015).